Why Diverse Board Teams Make Better Business Decisions

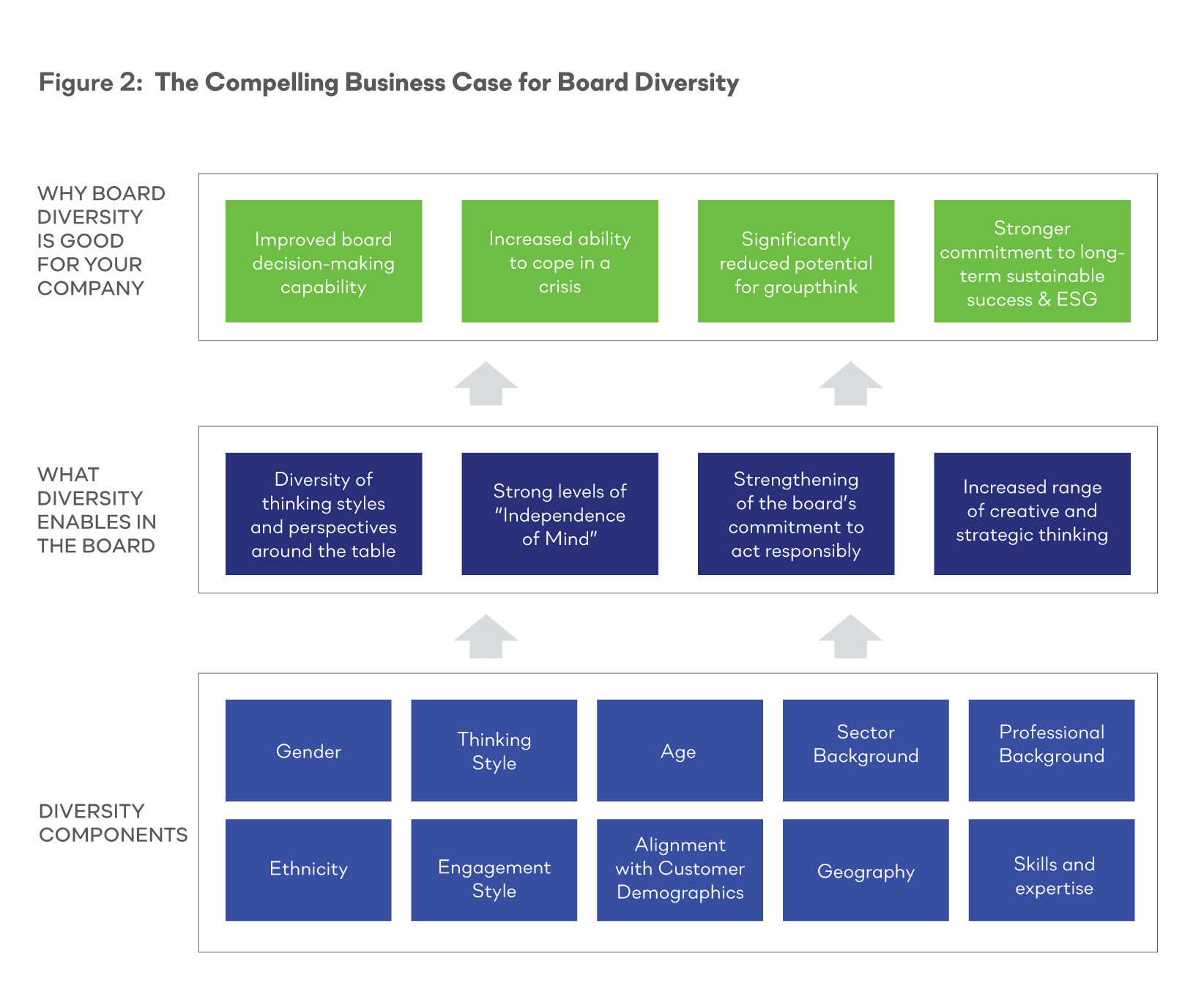

The fundamental responsibilities of a board of directors are to direct and control the organization, oversee management and provide strategic guidance. While the calibre of board directors has a critical bearing on this, board teams have increasingly recognised the value that genuine diversity and a range of thinking styles bring to the board decision-making process. As significant change and volatility have become the norm for every sector, it has never been more critical for a board to have a vibrant mix of members across gender, age, thinking style, sector background, ethnic background, professional background and customer demographics to help the board optimise its decision-making.

A Bain & Company survey of almost 800 global companies shows that high-quality decision-making and strong performance go hand-in-hand. The study found a 95% correlation between companies that excel at making and executing critical decisions and top-tier financial results.

Diversity in Practice

In the aftermath of the financial crisis, a diverse workforce has become even more of a priority for financial service companies. According to Eileen Taylor, managing director and global head of diversity at Deutsche Bank, “The crisis made our diversity efforts more intense. We are a survivor because of our relative diversity.”

Deutsche Bank invested in developing its pipeline of senior female leaders after internal research revealed that female managing directors who had left the firm did so because they were offered better positions elsewhere. In response, Deutsche created a sponsorship program aimed at assigning women to critical posts. The company paired female executives with executive committee members who served as mentors. As a result of this program, one third of the participants were promoted and another third were deemed ready for promotion.

(Source: Forbes INSIGHTS)

Diverse perspectives open the aperture of opportunities and make it easier to spot challenges and opportunities as they arise—especially ones that may damage the brand or obstruct growth— by merely including people who think differently. Collective intelligence stems from the following key dimensions:

- Diverse teams focus more on facts and process them more carefully. Diverse groups are more likely to focus on facts over assumed knowledge. They are also more likely to apply a higher degree of scrutiny to data, given the various critical perspectives they bring to the table.

- Diverse teams drive innovation. The more diverse the teams are across dimensions from gender to culture and age, the more likely they are to spark serendipitous opportunities for collaboration.

There is never only one way to solve a problem. The unique blend of background, experience, and ways of thinking that each person brings to the table shapes their approach to business. Diverse teams are better problem solvers. We can foster better decision- making by ensuring that boards have a wide variety of viewpoints well represented. Diversity stretches teams in ways that can be uncomfortable but effective.

Understanding the Problem Of Groupthink—and How Diversity Can Mitigate It

Groupthink (n.)

A phenomenon that occurs when a group of people make irrational or dysfunctional decisions due to a desire to conform

A perennial challenge facing all boards is the problem of groupthink — when the board settles into a comfortable groove, inhibiting disruptive, innovative ideas and discussion. In such homogeneous environments, genuine challenges to ideas and people fade or are discouraged and the norm becomes “protecting the status quo.” At the board level, groupthink represents a psychological phenomenon in which the overriding desire for harmony or conformity within the group results in dysfunctional or sub-optimal decision-making outcomes. In practice, this dynamic often results in attempts by board members to minimise conflict, reach consensus decisions without critical evaluation of alternative viewpoints by actively suppressing dissenters, and isolate themselves from outside influences. Groupthink within boards has played a major role in many corporate collapses and scandals across the world. This phenomenon can generate problems including:

Excessive risk-taking and blindness to threats – This is the most serious manifestation of a groupthink problem and was seen extensively during the global financial crisis. Often in this scenario, the chairman and non-executive board members lose sight of their responsibility to genuinely challenge a high-risk aggressive strategy proposed by a CEO and executive team.

A board that is not genuinely challenging its strategy, its understanding of the dynamics of the marketplace, its competitive position, serious potential risks on the horizon, can be vulnerable to a serious disruption or crisis.

Zero risk-taking – It may seem paradoxical but many organization fail to deliver on their potential because the board gets stuck in its comfort zone. In this environment, the board goes through the motions and either misses or is unable to fully engage in exploring significant opportunities to increase shareholder value. This is not to be confused with a situation whereby shareholders have mandated a conservative approach to new market opportunities.

Lack of challenge and debate – When each board member thinks similarly, the level of genuine, robust challenge or critique may be limited. This can negatively impact the board’s ability to excel and perform at a high-level.

Progressive boards often find that the key to significantly reducing the potential for a groupthink problem is to ensure a genuine diversity of board members with a vibrant range of thinking styles and independent approaches to problem-solving. Fostering this environment is more likely to generate a “virtuous cycle of challenge, debate, respect and trust” wherein creative thinking, out- of-the-box perspectives and constructive dissent are encouraged. As a result, board discussions may yield more fruitful discussions, explore the full range of options and perspectives, and minimise the risk of groupthink.

How Diversity Helps Boards and Teams Navigate Crisis Management

Through the financial crisis of 2010 and amid the unfolding COVID-19 crisis, board diversity emerged as a key attribute of boards that excel in crisis management. The core drivers of this include:

• Perspectives – The ability of a diverse board team to take a step back and take a brutally honest, thoughtful view on the nature of the crisis, its impact on customers, employees, and other stakeholders

• Independence – Diverse directors coupled with the “independence of mind” of the non-executive directors avoid serious groupthink tendencies at the board level

• Critical thinking – An increased ability to leverage a wide range of thinking styles, experiences, professional and sector expertise to develop a range of approaches to the crisis

• Innovation – A wider range of methodologies and ways of working help develop innovative approaches and solutions to complex problems

• Strategic agility – Diverse boards demonstrate greater agility in making major strategy changes and business model shifts

Performing Boards, Performing Companies

The factors that impact a company’s performance are complex and multi-faceted. They range from the quality of goods or services, business and pricing models, financial strength, market and competitive dynamics to the quality of execution by the CEO, executive team and employees in delivering to and supporting their customers day-to-day. While there is a significant amount of global research over the last two decades, which demonstrates a strong correlation between board performance and company performance, many company boards are still unaware of the strong link between their performance as a board and the overall company performance.

Notes from the Field: How Diversity Yields Significant Dividends

- McKinsey & Company’s global study of more than 1,000 companies in 15 countries found that organization in the top quartile of gender diversity were more likely to outperform on profitability — 25% more likely for gender-diverse executive teams and 28% more likely for gender-diverse boards.

- A study across Austria, Germany, and Switzerland by Boston Consulting Group and the Technical University of Munich found higher levels of diversity in management positions contributes to increased revenue from new products and services. Companies that establish favorable work conditions for employees have higher EBIT margins (17%) than those who do not (13%)

- A Wall Street Journal ranking of companies in the S&P 500 based on ten metrics related to diversity and inclusion performance finds that companies with women in leadership and a focus on diversity and inclusion generated a higher operating profit margin (12%) compared to the lowest-ranking companies (8%). When the researchers examined average compounded annual total stock returns over both five years and ten years, they again found that the highest- ranking companies outperformed the lowest-ranking companies.

- MSCI finds that companies with gender-diverse boards are more likely to have superior talent management practices. In particular, companies with three or more women on their boards and leading talent management practices produced higher ROE (Return on Equity) and experienced increased employee productivity, as measured in compound-annualized growth rates of revenue per employee.

The literature on the link between diversity and financial performance is well-founded. It is rooted in a company’s ability to attract top talent, maintain employee satisfaction, and return customers- -all of which lead to increased financial returns. References are included in the appendix.

The Role of the Board’s Instinct and Intuition in Managing Risks

Outstanding board teams possess a highly developed instinct and intuition that enables them to quickly identify concerning trends in areas such as organisational performance, problems developing in customer acquisition and retention, and excessive build-up of serious risks. At the core of a board’s ability to develop this skill is a genuinely diverse board team with a wide range of thinking styles, strong levels of emotional intelligence, curiosity, a wide mix of sector/professional backgrounds, and a board culture that encourages a healthy vibrant mix of perspectives.

At a time where boards have never faced greater levels of organisational risk, a diverse board team’s strong a instinct and intuition significantly improves its risk management capability— particularly in its ability to identify a wider range of risk types but also to identify and face up to the serious risks that can be missed or downplayed due to groupthink.

A key component of any enterprise risk management strategy is diversification. This principle not only applies to corporate strategy but also to team composition. To mitigate risk, companies need systems and processes prepared to address a wide range of possible business scenarios.

In the face of unknowns, diverse boards can help management identify potential blind spots in a company’s strategic plan or a concerning increase in the probability of a key risk materialising.

Practical steps to enable the board leverage improved board diversity and enhance its risk management capability consist of:

• Evolving the composition of the Audit/Risk Committee to ensure a strong mix of financial, internal controls, and risk skills as well as committee members with diverse backgrounds.

• The board chair making additional room in the agenda for a broader risk management focus that takes advantage of the board’s greater diversity.

• The board regularly looking beyond “traditional risks” to take into account a changing environment. Technological and business model changes require boards to consider emerging risks that may lack historical precedent.

ESG Focus for Long-term Gains

In recent years, boards have significantly increased their focus on Environmental, Social and Governance (ESG). While this paradigm shift was initially driven by large institutional

investors in publicly listed companies due to demands from clients and public scrutiny, ESG has now emerged as a core focus area for all boards. Shareholders, employees, customers, partners and broader stakeholders increasingly expect boards to embrace ESG and demonstrate a commitment to long-term organisational sustainability. Today, ESG is critical to attract investment, talent, and plays a major role in procurement processes in the public and private sectors.

For Investment Funds

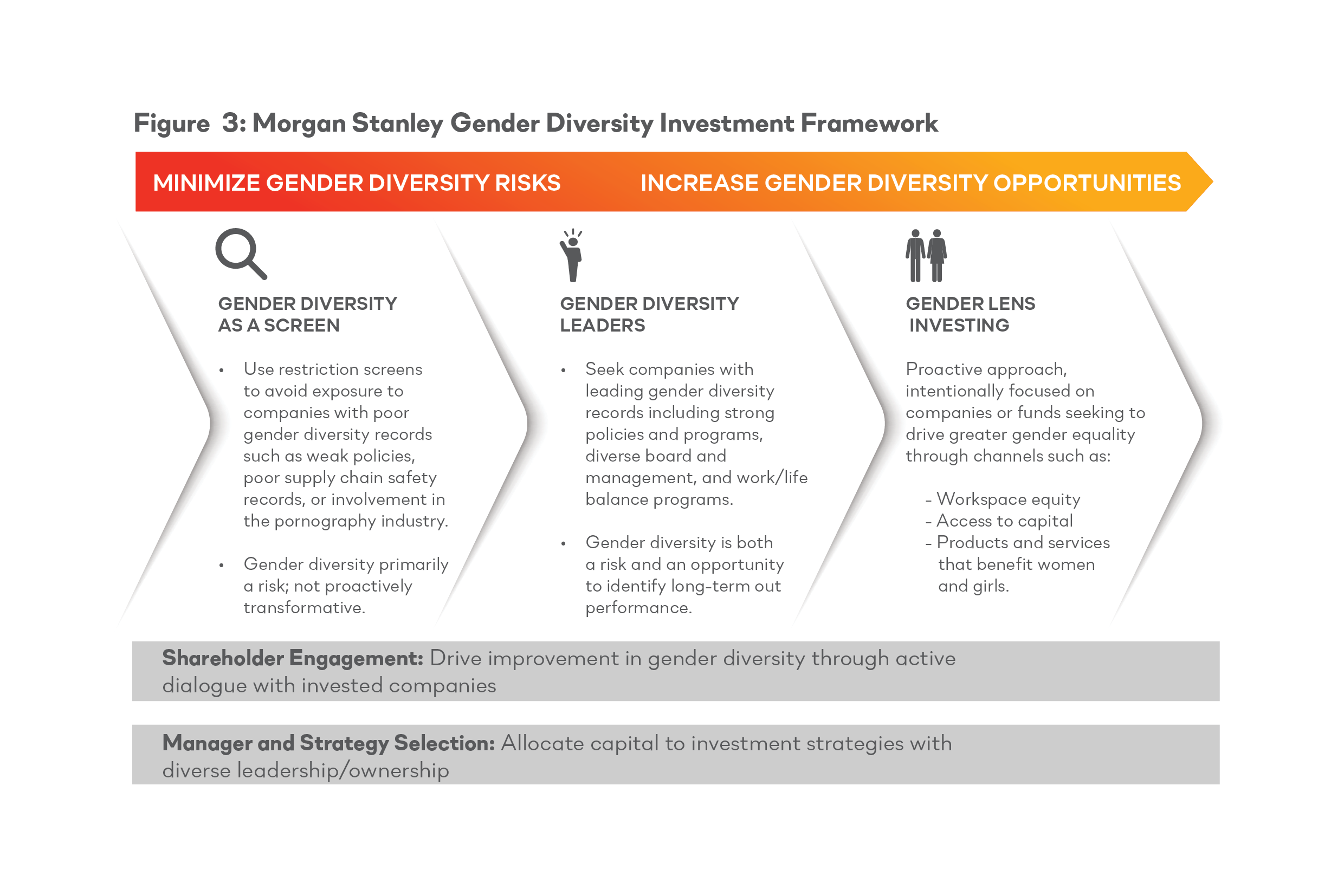

On investor-alignment and harnessing diversity risks and opportunitiesAsset owners, development finance institutions as well as private fund and portfolio managers are strategically placed to use investment capital as

a tool to drive diversity within portfolio and pipeline companies. Not unlike the evolution and acceptance of ESG, where diversity is prioritized within the regulator and investor community, there is the opportunity to drive top down and ecosystem-wide changes. With the investor community increasingly awake to the value of diversity, there are approaches for integrating criteria to mitigate investment risks (reputational, operational, and commercial) and harness opportunities (such as productivity, customer acquisition, and talent retention) in order to balance the financial, sustainability and diversity goals of a company.

A fundamental proof point for any board in terms of its commitment to ESG is its board diversity, which lies at the heart of an organization’s commitment to the “S” and “G” in ESG. Improving board diversity as part of concretely demonstrating commitment to ESG has been a major beneficial step for many boards internationally across all sectors and scale of organizations.

Many boards have found that in strengthening their board diversity, key ESG skillsets are added to the board.

- According to researchers at the University of California, Berkeley, companies with one or more women on their boards are significantly more likely to have improved sustainability practices. Moreover, these female leaders are more likely to prioritize environmental issues.

- These findings are not only limited to the private sector: a recent study found that women in the United States House of Representatives consistently outvoted their male colleagues on environmental protection from 2006 until 2015.

- A recent PwC report, Annual Corporate Directors Survey, highlighted that female board directors see a greater connection between company strategy and ESG issues supporting investor demands for a greater focus on ESG on the board’s agenda.

This multiplier effect creates a virtuous cycle in which the board team’s stronger ESG focus accelerates ESG adoption across the organization which translates over time to concrete business benefits, improved support from investors and shareholders, and positive recognition in the eyes of customers and partners of the organization’s genuine commitment to ESG and sustainability.

Institutional investors can make a meaningful difference by holding fund managers, portfolio managers and investee companies accountable for prioritising diversity by:

- Communicating their position on diversity and inclusion on their websites and investment documents

- Setting transparent benchmarks for portfolio managers and investors to ensure there is a clear framework for the effective allocation of resources into companies

- Including diversity clauses in term sheets and investment agreements

- Requiring fund managers and investee companies to use the BDC Toolkit when hiring board members and senior management

- Requiring fund managers to track, monitor and report relevant diversity metrics at the fund level, as well as the investee company level, both pre- and post-investment, and on a periodic basis

The financial services industry, including investment management, can gain considerably from incorporating diversity of thought and talent to meet the evolving challenges and needs of the ecosystem.

Research indicates that gender balanced investment teams are correlated with higher returns. The investor community can lead by example in driving diversity and inclusion amongst fund managers as well as within portfolios.